When buying a home, many homebuyers tend to search for the best mortgage interest rates available. While some may find that perfect rate, others may opt to take advantage of lender-provided options, such as mortgage points.

Mortgage points are designed to help buyers bring down their interest rates by paying them ahead of time. Sometimes considered “discount points,” mortgage points allow you to pay a larger down payment up front to quell your interest rates throughout the life of your loan.

While that sounds like an excellent option for those searching to put a dent in their future monthly payments, there are a few items to consider.

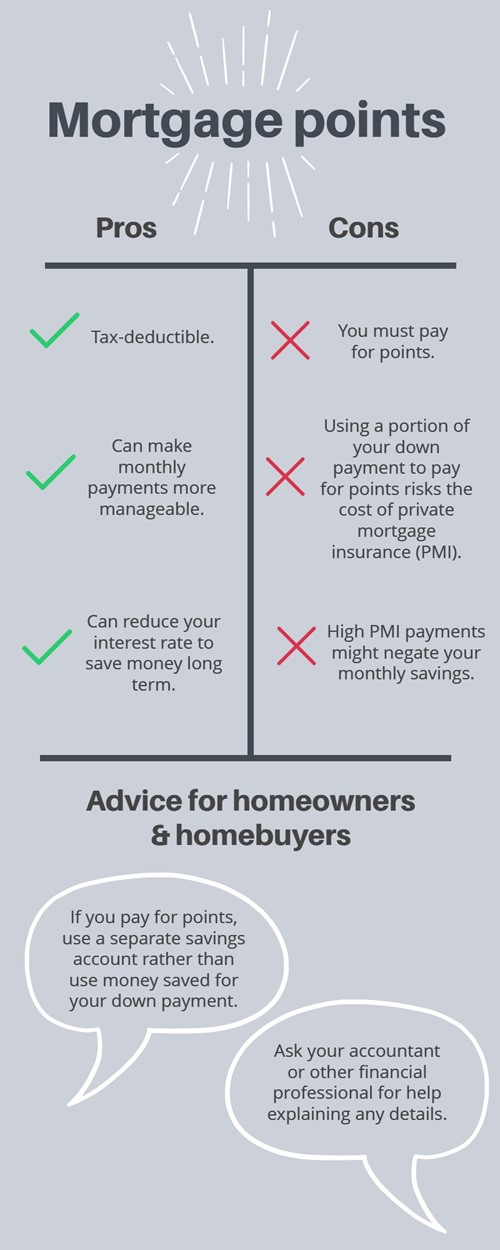

Here are some pros and cons of mortgage points and tips on what to do for your situation:

When delving into the world of mortgage discount points, the immediate hook is your monthly savings in the long term. Mortgage points are exceptional ways to bring your mortgage interest rate into a desirable range, creating more manageable payments on a monthly basis.

Another fantastic feature of mortgage points is they’re tax-deductible. According to the IRS, you can itemize your deductions on a Schedule A, or Form 1040, and only need to meet a few requirements, such as using the “cash method” for tax reporting. You’ll also need to have your primary residence as the loan’s security method.

There are great advantages to discount points. However, there are a few cons that may surface with this kind of lender program. For example, if you plan to pay for mortgage points, try to secure a secondary savings account to make that payment instead of taking it from your down payment.

If you take the funds from your initial down payment, you could end up paying less than the 20% needed to avoid private mortgage insurance, or PMI. Since PMI can increase your monthly payments, you may end up paying more on your monthly mortgage than you’d save, or you could end up pushing out your break-even point, prolonging your larger payments.

There are ways to use mortgage points to your advantage. For starters, make sure you have an in-depth understanding of your current monthly finances, your projected finances and a financial roadmap for the next few years that you can follow easily.

Another fantastic idea is to get in touch with your loan officer or lender. Have them explain your options, what the estimates are for the next few years (or further) and any tips they may have for you. If you find yourself in the beginning stages of your home search, ask your real estate agent for any connections or recommendations to a lender or loan officer.

Knowledge and Experience You Can Count On! For most families the decision to buy a home or sell their home is an exciting and complex adventure that involves a lot of preparation and work. It can also be very time-consuming and costly if you're not familiar with all aspects of buying or selling a home. I can provide you with the best information and resources to help make this experience an enjoyable one. One of my specialties is representing the best interests of St. Lucie County and Martin County FL areas.

My comprehensive, high-quality services can save you time and money, as well as making the experience more enjoyable and less stressful. I have lived in St Lucie County for almost two decades and with over 20 years of experience as a local market expert, I can help you make the most informed decision. Whether you're buying a starter home, your dream home,an investment property, or selling your largest financial asset, I know how to handle every aspect of the buying and selling process. I can strategically market and showcase your home to find you the best deal in this market.

My top priority is to provide you with comprehensive, high-quality service. So when you decide to buy or sell your home, please contact me and let's get started! The secret to the success of Keller Williams is in the quality of its people and the relationships that they have with the communities they serve. Customers appreciate the depth and expanse of local knowledge the company’s career-oriented agents work hard to maintain. The company focus has expanded to offer our clients a full spectrum of real estate related services.